5 Safe & Convenient Payment Apps for Club Dues

As a relatively new Toastmaster member, I wondered what options members have to pay their membership dues, given the difficulty of making payments with cash or checks due to social distancing measures and remote club meetings. Luckily, thanks to advances in technology, cashless electronic payments are becoming more prevalent, giving convenience and peace of mind to both treasurers and members. Toastmasters club treasurers have many options today to enable members make their payments securely and safely.

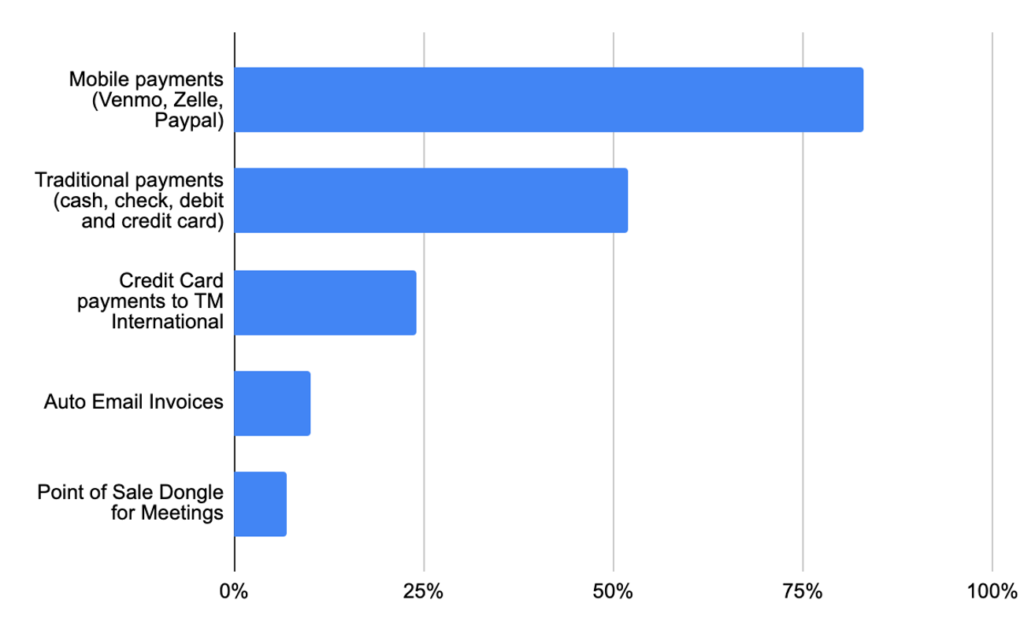

To answer the question of What payment methods do you use to accept membership dues?, a survey was sent to the respective District 101 treasurers. The chart below shows the results of the survey sent to the treasurers, with 29 responses, equivalent to a 19% response rate.

In essence, the vast majority of clubs accept electronic and mobile payments, along with accepting traditional ways of payments such as cash and checks, along with debit and credit cards. Each form of payment offers convenience, but the method of transferring money and fees charged vary depending on the company used.

Today, there is a wide variety of types of payment methods to choose from, so in this article I decided to focus on the top methods of payments used by the clubs within Toastmasters District 101. By understanding how each one of them functions, and knowing what payment options are available to members, it can help the clubs decide which payment methods to integrate while optimizing the tradeoffs between security, convenience and costs/ fees.

I categorized the methods of payment into two types: a) electronic or mobile payments and b) traditional payment methods.

Electronic or Mobile Payment Methods (Peer to Peer payments)

Peer-to-peer payment systems — also known as P2P payment apps or money transfer apps, allow users to send one another money from their mobile devices through a linked bank account or card. Many clubs start out with peer to peer payment systems but might later mature to business type accounts to ensure that Toastmasters and personal banking remain separate. The downside to business type accounts can be when a new Club Treasurer or President are elected and the account needs to migrate to the new officers. It’s less flexible and immediate compared to the peer-to-peer type.

#1 Paypal

This method of payment is accepted by many Toastmasters Clubs. It is the most commonly used digital wallet with over 305 million active users and it is widely available in 202 countries. The cost for Toastmasters, an approved nonprofit, is 30 cents plus 2.2% per transaction, which is reasonable when considering ease of use and convenience. For more detailed guidance and recommendations on using Paypal as an online payment option for collecting club dues, please read the online information on PayPal for Club Treasurers provided by District 101 on its website.

#2 Venmo

(owned by Paypal) is free and great as a peer to peer payment method. This type of payment is great for mobile and social feed transactions. As with Paypal, it can be connected to the member’s bank, or to multiple debit and credit cards. It is safe, the online financial transactions are done without giving away the member’s personal information.

#3 Zelle

Zelle transfers money within minutes and partners with banks and credit unions. Members can safely and easily send member dues to their treasurer directly through their banking app – or the Zelle app if their bank doesn’t currently offer Zelle.

#4 Google & Apple Pay

These convenient apps provide an easy and convenient way to transfer money; Google Pay even synchronizes with Gmail. There is no need to carry cash around nor pins to remember. These services, when using a phone, provide tighter security features using fingerprints or face recognition. There are many other companies offering similar online or mobile services, such as Cash App (owned by Square), or even social media money transfers.

#5 Point of Sale (POS) Dongles

Dongles are pocket-sized devices that are used to electronically transmit financial data for a payment transaction. Swiping a credit card or a debit card through a dongle enables clubs to sign up members or process renewals on the spot. The two main companies that offer POS dongles are Paypal and Square. The price for the Square POS Dongle is $49, which offers the ability to read credit card chips and contactless payment devices. The transaction fee for this service is 2.6% + 10¢. The paypal POS dongle has a cost of 59.99 which reads credit card magnetic stripes, in addition to the ability of reading credit card chips and contactless devices. There are no long term commitments or monthly fees on either Square or Paypal. A shopping cart can be created with categories such as new members, renewals and dual memberships, and customized receipts can be automatically generated after payment has been posted. The club can send invoices straight from the POS dongle on a mobile device or from a laptop right to the member’s inboxes. Furthermore, the system provides easy to navigate dashboards to categorize payments and generates itemized reports with invoice and payment status.

Traditional Payment Methods

Cash

The use of cash as a payment method allows you to avoid transaction fees, but its decline has been accelerated in recent years due to the technological advances in the financial sector. Furthermore, paying with cash does come with several non-health related risks, since it can be lost or stolen. Moreover, it cannot be sent over the mail, requiring a face-to-face exchange.

Checks

Checks are another payment method used by members with checking accounts. As opposed to cash, the money is traceable and can be sent by mail, adding to the convenience. But in terms of member onboarding speed, the money is not readily available. Depending on the bank, it can take a few days for the money to be available in the payee’s account. There is also a risk that if the issuer doesn’t have enough money in his or her account to cover a check by the time it clears, the check may bounce — in other words, it will be returned to the payee who tried to cash it. In addition, both the issuer and the payee will be charged bank fees, creating an additional headache for both parties.

Credit cards

These are used frequently—even by people who have access to cash—because they offer another level of security. Credit cards normally charge a fee to the club. Since the clubs are non-profits most will want to adjust the membership fee to INCLUDE the credit card fee. This way the individual member pays for the convenience of the credit card transaction so that the non-profit club doesn’t have to. In general, the average fees for credit card processing ranges from 1.5% to 2.9% for swiped cards, and 3.5% for keyed-in transactions.

Here is a recent breakdown of average costs for four major credit card networks:

American Express – 1.58 – 3.30%

Discover – 1.53% – 2.53%

Mastercard – 1.29% – 2.64%

Visa – 1.29% – 2.54%

As people are becoming more and more comfortable with electronic means to perform financial transactions, the need for traditional payments (paper and coin currency) is decreasing. Fortunately, there are many cashless systems options for Toastmasters treasurers to offer members the flexibility to timely and conveniently pay their dues. Furthermore, electronic payments can enable clubs to onboard new members quickly and on the spot (with the use of the PoS Dongle). In a world looking for convenience and simplicity, the clubs can take advantage of these financial technological advances to provide a wide variety of e-payment options for their members.

![]()

Written by Juan González from Big Basin Toastmasters Club